Resources

Forex Treasury Insights

Welcome to your go-to resource for insights and expert articles on navigating the complex world of foreign exchange risk management. Discover how our tailored forex strategies and comprehensive support can empower your internationally trading business against the unpredictable tides of currency markets.

Discover how importers and exporters can build sustainable supply chains by integrating treasury, logistics, and digital trade solutions to strengthen global resilience.

Join Sharon Constançon, Bruce Trebble, and Linda Reddy as they explore the critical elements of sustainable supply chains in this insightful podcast. Covering financial, operational, and technological resilience, the discussion offers practical guidance for businesses navigating today's global supply chain challenges.

A strong FX treasury foundation is the cornerstone of successful cross-border operations. Learn how aligning strategy, policy, and governance can reduce currency risk and protect your bottom line.

Missed the live event? Watch the full replay on Building a Solid Forex Treasury Foundation and learn how to align your FX strategy, policy, and stakeholder management to enhance your forex risk practices.

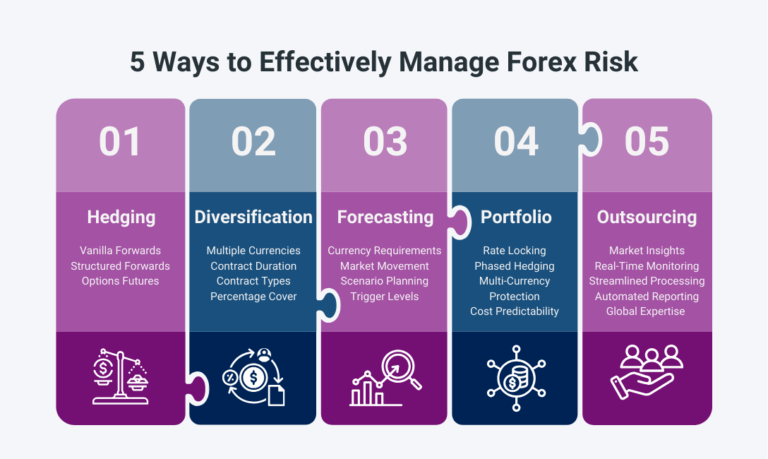

Discover five effective ways to manage your organisation's foreign exchange risk, protect against currency volatility, and maintain financial stability with Valufin's expert strategies.

Explore how FX strategy, digitisation, and policy-aware planning can help global businesses protect margins and build resilience in disrupted supply chains.

Tune in to discover how proactive planning, digital transformation, and integrated risk strategies can help businesses protect their supply chains, strengthen treasury practices, and stay competitive in a fragmented global landscape.

The traditional mince pie, a staple of British Christmas celebrations, might cost more to produce this year, as ingredients like butter see an 83% price increase. For small businesses already contending with rising energy bills and inflation, effective financial planning and forex strategies are now more critical than ever.

Recent tariff threats by U.S. President-elect Donald Trump illustrate the real and immediate impact of geopolitical developments on currency values. Businesses involved in cross-border trade—especially those dealing in high-volume foreign exchange transactions—must grapple with the dual challenges of market volatility and rising costs.

Forex Treasury Management is complex, but with the right strategies and a structured approach, businesses can turn challenges into opportunities, mitigate risks, and optimise global financial performance. Discover how in our latest Forex Insights.

68% of CFOs cite currency volatility as a major business risk. This webinar replay explores 7 structured strategies to manage FX risk, improve treasury performance, and build financial stability in volatile global markets.

Master the essentials of forex risk with Valufin’s practical framework. This session offers key strategies to help you manage exchange rate fluctuations and build confidence in your international financial operations.

Discover how tailored forex treasury management solutions can help importers and exporters minimise risk, optimise costs, and protect profit margins in volatile markets.